what does my credit have to be to buy a house

What Credit Score Practise Yous Need to Buy a House in 2022?

Author: Dan Light-green | Published: March 26, 2021 | Last Reviewed: Apr 11, 2022

A lot of outset-time home buyers worry that their credit scores are too low to buy a home. First, know that whether your credit score is "adept" or "bad" is subjective and won't touch on your home-buying. Second, mortgage lenders are bound past specific rules which decide what credit scores you need to buy a house, and those rules vary by your loan type.

Conventional loans are the most common loan blazon. On the credit score scale, which ranges from 350-850, conventional loans crave a credit score of at least 620. Other loan types permit for lower credit score minimums, and some mortgage programs have no credit score requirement whatever.

Read on for details by loan type, or jump to learn more nearly your credit score:

- Minimum Credit Score to Buy a House by Loan Type

- What Affects Your Credit Score?

- How to Better Your Credit Score

- What Mortgage Lenders Await For

- How to Purchase a House With a Bad Credit

Minimum Credit Score to Buy a House past Loan Type

Conventional Loan | Credit Score: 620

Conventional loans are the most common home loan and have a hard minimum credit score of 620. Conventional loans are issued through mortgage lenders, mortgage brokers, and credit unions. Conventional loans are the default option for home buyers because of their low rates and uncomplicated approvals.

Conventional loan approval requires:

- A mortgage application

- Lender-required documents

- Credit history

- Electric current credit score

FHA Loan | Credit Score: 580

FHA mortgages are the original mortgage loan, developed by the Federal Housing Administration in the 1930s to go on homeownership attainable. FHA loans are more inclusive than other loan options because of their relaxed down payment requirements, and because the FHA doesn't change your interest rate based on your credit score.

In fact, FHA loans don't require home buyers to have a credit score at all, although many lenders want to see a minimum score of 580.

FHA loan approving requires:

- 3.5% down payment

- Loan lengths must exist xv years or longer

VA Loan | Credit Score: 580

VA loans are backed past the Department of Veterans Affairs. VA loans are affordable home loans for active-duty servicemembers and veterans.

Because the VA guarantees its loans against losses, mortgage lenders make VA loans at very low-interest rates and, historically, VA mortgage rates are often the lowest of all available mortgage loans. VA loans don't require a downpayment.

VA loans:

- Are available as 100% mortgage loans

- Take lower interest rates equally compared to conventional loans

- Require a Document of Eligibility (COE)

USDA Loan | Credit Score: 620

USDA loans are government-backed mortgages available for homes exterior of densely-populated areas. The USDA plan covers almost 91% of the U.Southward. including rural areas, small towns, and many suburbs.

USDA mortgage loans don't crave a down payment and offer interest rates that average 0.50% lower than conventional loan rates. USDA guidelines require credit scores of at to the lowest degree 620, just exceptions can be made for dwelling house buyers with extenuating circumstances.

USDA loans:

- Can only be used for non-urban home purchases

- Have no downward payment requirements

- Require a credit score of 620 or higher

Jumbo Loan | Credit Score: 680

Jumbo loans service home buyers whose mortgage loans are too large for the local mortgage loan limit. There is no specific credit score requirement for a jumbo mortgage, though higher scores are more likely to be approved and may be assigned a lower involvement rate.

Jumbo loans can be used for a variety of belongings types.

Jumbo loans:

- May crave a downwards payment of betwixt 5% and 25% depending on credit and income

- Require higher credit scores

- Are not authorities-backed

What Changes Your Credit Score?

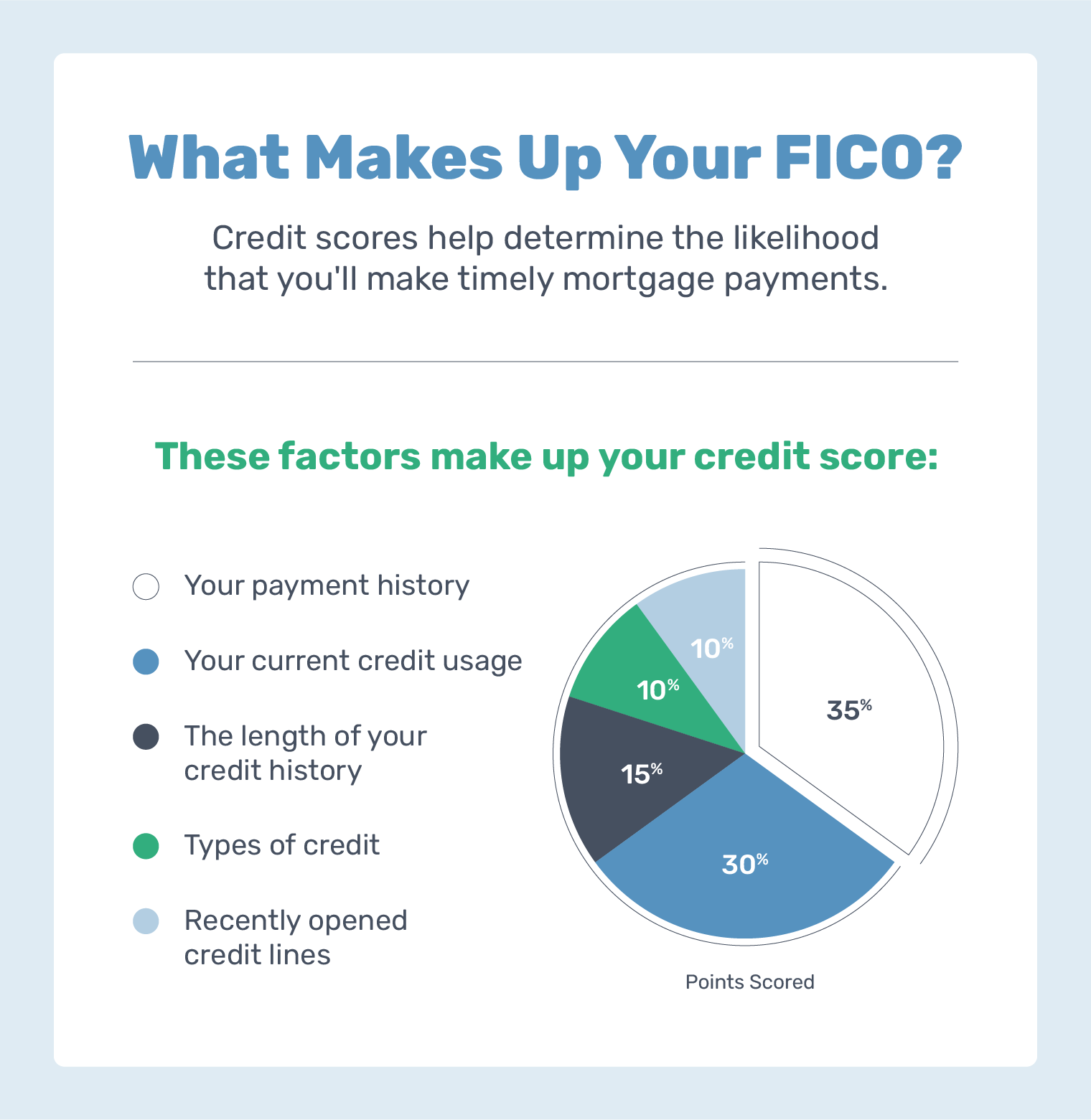

Credit scores help your lender determine the likelihood that you'll make timely mortgage payments. Fair Isaac and Co. (FICO) uses these factors to calculate your credit score:

- Your payment history (35%)

- Your current credit usage (xxx%)

- The length of your credit history (15%)

- Types of credit (10%)

- Recently opened credit lines (ten%)

These 5 factors provide a glimpse into your financial habits and history and help lenders assess your financial wellness.

Home buyers with lower credit scores are typically assigned a college interest charge per unit.

There is no way to get around a credit bank check. It is one of the things you need to buy a dwelling during the mortgage pre-blessing stage so exist certain to learn more near how a mortgage pre-approving affects your credit score.

How to Improve Your Credit Score

To boost your credit score for your upcoming mortgage approval, first, check your credit report to acquire what's comprising your score. All consumers become access to a costless almanac credit report at AnnualCreditReport.com.

If you've never reviewed a credit report, it can feel overwhelming. There are public resources that tin help yous, or you lot can ask for help in our conversation. Nosotros'll consider the factors that impact your credit score and discuss ways to brand improvements, like opening a secured credit card account or shifting balances between charge cards.

Here are the best habits to improve your credit score:

- Pay your bills on time — Payment history accounts for 35% of your FICO credit score

- Lower your credit utilization — Increment your debt payments temporarily or request a credit limit increment

- Avert new credit lines — Difficult credit inquiries are performed for a new line of credit and tin can affect your credit score for the next 6 months

- Don't close erstwhile accounts — Keep old credit lines open and catch up on old payments or delinquencies

- Be patient — It can take upward to 6 months to make big changes in your credit score, so do the work and look it out

Credit scores don't improve overnight, and keeping your debt to a minimum pays off when y'all're planning to purchase a business firm. Even small credit score improvements tin reduce the interest rate you get, which saves you lot tens of thousands of dollars in the long run — plenty to fund a retirement or higher tuition!

Learn more about options for ownership a home with a low credit score.

What Mortgage Lenders Look For When Approving a Domicile Loan

When you utilise to become pre-approved, your lenders will review your credit history and consider your electric current credit outlook. This includes looking at:

- How on-fourth dimension have you been with your payments and obligations?

- What does your current debt load expect like, and how is it spread out?

- How much feel do yous have managing credit?

- Have you been recently trying to learn access to new sources of credit?

- Do y'all permit items go into collections?

- Take you previously filed for bankruptcy?

Lenders inquire these questions to become comfortable with yous. Your fiscal health isn't the only consideration lenders make, merely how you manage your bills tells a large role of your story.

Lenders as well look for specific credit events known as derogatory items, similar defalcation or delinquent accounts.

Derogatory items don't disqualify a mortgage blessing. Mostly, it's just required that they're historical events and not current ones. For instance, you tin go approved for a mortgage if you lot've declared defalcation in the by, or if you've lost a home due to foreclosure.

Lenders know that life is unexpected and bad things happen. What's of import is what'due south happened in the time since the derogatory outcome occurred.

How to Buy a House With Bad Credit

You don't have to give up on your dream of homeownership considering of a low credit score or less-than-perfect credit history Hither are a few ways first-time home buyers purchase homes with bad credit or no credit:

Abolish Out Your Low Credit Score With A Larger Downwardly Payment

Low credit scores create chance for mortgage lenders, and large down payments have the risk away. Therefore, buyers with the ability to increase their downwards payment size are more likely to become mortgage-approved.

Enquire Multiple Lenders

The U.S. government establishes rules for conventional, FHA, VA, and USDA loan approvals, but mortgage lenders sometimes create boosted, more stringent requirements to be met. If your mortgage application doesn't pass its offset exam, try once again with a dissimilar mortgage lender. Information technology'southward mutual for loans to be approved on the second or tertiary attempt.

Get a Co-Signer

If you're unable to qualify for a mortgage and have somebody in your life who would serve as co-signer, inquire your mortgage lender the all-time path frontward. A co-signer is somebody who agrees to joint responsibleness for your mortgage, including repayment.

Co-signers don't accept to alive with you, but they volition share ownership of the dwelling house. If yous can't authorize on your own, and so this is worth exploring.

Your credit score isn't the simply cistron for mortgage blessing. Even so, it'south a key indicator of your fiscal health. Rail your credit, brand on-time payments, and get assist to choose the home loan that's right for you. Chat with us if y'all have questions about your credit score and loan options.

Happy homebuying.

Become pre-approved for a mortgage today.

Source: https://homebuyer.com/learn/what-credit-score-do-you-need-to-buy-a-house

0 Response to "what does my credit have to be to buy a house"

Post a Comment